|

For Immediate Release:

Monday, October 1, 2012

6 p.m.

Beyond the shale! Strict liability for fracking, putting Wall Street on the hook, should allay environmental fears

(BOSTON, MA) As the nation moves toward energy independence with its new discoveries of shale gas throughout the U.S., public policy should emphasize a strict liability approach to holding firms liable according to a new study by the Beacon Hill Institute at Suffolk University.

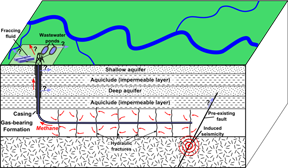

The nation is in the middle of a natural gas boom made possible by new drilling technology known as “fracking,” The process is not without controversy. Fracking involves the blasting of shale rock formations by injecting enormous quantities of water and smaller quantities of chemicals underground to access trapped oil and natural gas.

Environmentalists have raised concerns that fracking could contaminate aquifers and cause earthquakes. Even though they are remote, these extreme events should not be dismissed. The market, rather than heavy-handed government regulation. may provide a solution, however.

The authors of the study, entitled “Strict Liability for Fracking: Risks Should Fall on Wall Street, Not Main Street,” recommend that energy companies should be underwritten by well-capitalized financial firms who can shoulder the burden should an extreme disaster hit. This, in effect, will force Wall Street to make the victims of any disaster whole, should a disaster occur.

“The key for good behaviors by markets are getting the incentives right, and that means privatizing both gains and losses,” says the lead author, Ryan Murphy, a PhD candidate in Economics at Suffolk University and a research economist at BHI. “This is the basis for conceptualizing the risks of fracking in terms of who must pay when something goes terribly wrong.”

Murphy along with fellow researchers Amy Purpura and Malia Dalesandry, used a statistical method which takes into consideration the possibility that fracking may cause an event like a severe earthquake. They still found that potential benefits outweigh actuarial costs. With the correct institutions in place, fracking offers tremendous benefits at minimal costs.

The study is available at www.beaconhill.org.

.-30-

Last

updated on

02/27/2013 12:20 PM

� 1996-2011, Beacon Hill Institute.

All rights reserved.

|