< For Immediate Release:

October 30, 1997

Contact:

Frank Conte, Communications

617-573-8050; 8750

fconte@beaconhill.orgBHI State of the Household Survey

Fall 1997New poll shows overwhelming support for income tax cut

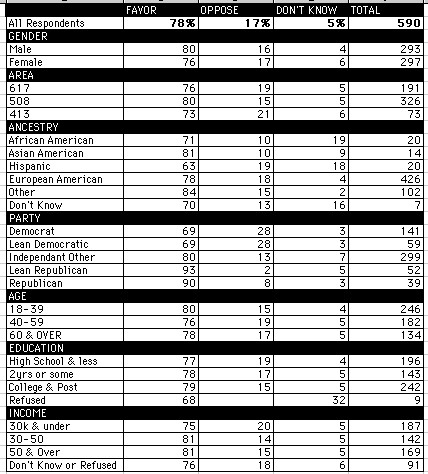

Boston, October 30 - A new statewide poll conducted by the Beacon Hill Institute shows that Massachusetts residents favor a proposed reduction in the state income tax by more than a 4-to-1 margin. The state currently taxes earned income and certain unearned income at 5.95%. The Beacon Hill Institute at Suffolk University asked 590 Massachusetts residents if they would support a plan to cut the tax rate from 5.95% to 5.00%. Seventy-eight percent (78%) of those surveyed said "yes." Seventeen percent (17%) said "no."Governor Paul Cellucci has offered the Massachusetts legialature a proposal that would phase in the tax cut over three years. A citizens group is currently circulating an initiative petition that would put a similar proposal on the 1998 ballot.

"Massachusetts lawmakers have, for various reasons, put Governor Cellucci's proposal on hold," said BHI Executive Director David G. Tuerck. "But our poll suggests that Massachusetts residents favor his proposal by a very wide margin."

Some lawmakers have argued against the tax cut on the grounds that an economic downturn could cause a slowdown in revenue growth. In upgrading the state's bond rating, Standard & Poors similarly cautioned this week against inviting a fiscal crisis reminiscent of the state's experience of the late 1980s.

Q: The state legislature is considering a proposal to cut the state income tax rate from 5.95 percent to 5 percent. People in favor of this say giving the money to the taxpayers will stimulate the state's economy. People opposed say that the state may need the money in the future when times are not so good. Do you favor or oppose cutting the state income tax rate from 5.95 percent to 5 percent?*

©1997 Beacon Hill Institute, All Rights Reserved.

"It appears," said Tuerck, "that Massachusetts voters are less persuaded by arguments such as these than they are by evidence that the proposed tax cut would exert a powerful stimulus to the economy." A BHI study released in September showed that the tax cut would add 105,000 new jobs, increase payrolls by almost $5 billion and increase capital spending by $21 billion.

The poll showed strong support for the tax cut across all demographic and political groups. The poll was conducted October 4-8, 1997 and has a margin of error of plus or minus 4%.

The Beacon Hill Institute at Suffolk University in Boston applies state-of-the-art economic methods to the analysis of current public policy issues.

*This survey was conducted for the Beacon Hill Institute under the supervision of Dr. John Blydenburgh and with the assistance of Commonwealth Consulting.

Format revision on 04-Mar-2005 10:22 AM

©2000-2005 Beacon Hill Institute for Public Policy Research at Suffolk University, All Rights Reserved